What to look for when Boeing reports results as Covid keeps it in ‘no man’s land’

Boeing is set to detail another rough quarter before the market opens Wednesday.

Here’s what to watch for when the company reports:

More losses, sales drop

Wall Street analysts polled by Refinitiv expect the aerospace giant to post a third-quarter loss of $2.47 per share, excluding one-time items, and revenue of $13.9 billion, a more than 30% drop from a year earlier.

Boeing’s stock has shed more than 50% of its value this year, while the S&P 500 has gained 5.3%, as the company struggled with the virus on top of the crisis following two fatal crashes of its bestselling 737 Max, the first of which occurred two years ago Thursday.

737 Max update

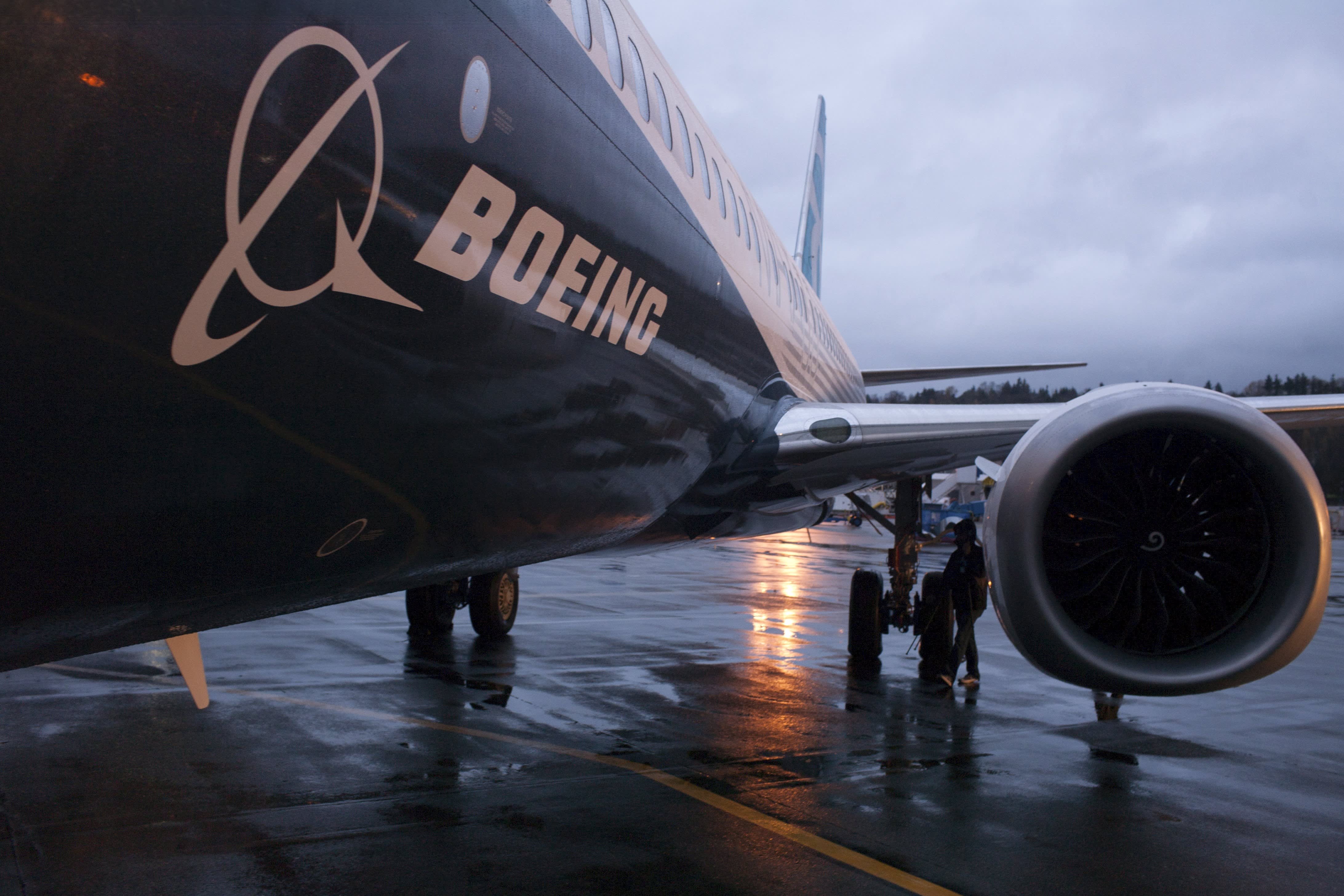

Regulators appear to be edging closer to lifting their flight ban on the 737 Max, after several design changes. Boeing executives are likely to provide more detail about their expectations. In July, the company said it expected to have Federal Aviation Administration approvals that would let it resume deliveries of the planes to customers in the fourth quarter.

Even if the company gets FAA and other regulator approvals, passengers will still need to feel comfortable flying on the planes. American Airlines, which has scheduled the 737 Max for late December, is planning to let customers tour the 737 Max at several U.S. airports next and have its pilots answer their questions. United Airlines and Southwest Airlines meanwhile don’t expect to have the planes in their schedules until 2021.

The manufacturer has more than 400 Max planes that have been produced but not yet delivered to airlines.

Coronavirus impact

The aerospace giant, its suppliers, customers and rivals are facing mounting and interconnected losses from the coronavirus pandemic‘s toll on air travel demand.

Customers like airlines are desperate to save cash. With demand at less than half of 2019 levels some are canceling or deferring deliveries. In the first nine months of 2020, Boeing lost a net 381 orders for new planes, including both cancelations and conversions. The coronavirus could diminish industry demand for more aircraft for the next decade, according to Boeing’s own estimates.

Cash burn woes

Airlines and other customers pay the bulk of an aircraft’s price when it’s delivered, so the dulled appetite for new planes is particularly painful for Boeing right now.

“One of the key problems that Boeing faces because of the Max situation and compounded by the pandemic is that production and delivery are not aligned,” said Robert Spingarn, an aerospace and defense analyst at Credit Suisse. “Production uses cash and delivery harvests cash,” which results in very extreme swings in cash flows.

Boeing delivered 98 airplanes in the first nine months of the year, compared with 301 in the same period of 2019.

The outlook for Boeing, like other companies tied to travel, is heavily dependent on a successful coronavirus vaccine or treatment, analysts say. Until then, or until the FAA clears the Max for flight, things are murky.

“They’re in no-man’s land,” said Jefferies aerospace and defense analyst Sheila Kahyaoglu. “It’s all Max and virus dependent.”

Analysts expect Boeing to report negative free cash flow for a sixth consecutive quarter with estimates of about $5.4 billion, which is a slight improvement from negative $5.6 billion in the three months ended June. 30.

Liquidity isn’t expected to be an issue after Boeing’s massive $25 billion debt sale this summer.

Employment and production

Boeing in July announced it would cut production of its 787 widebody Dreamliner to six a month next year and slow its ramp up of 737 Max production.

It is also consolidating its 787 production at its nonunion factory in North Charleston, South Carolina. The company executives will likely be asked whether there will be further reductions in production and in head count. Boeing warned on the second-quarter call that it could further cut jobs, saying it shed some 19,000 workers this year.

Article Courtesy of CNBC